Content

Its not all lender helps all of the cell phone or os’s, very speak to your bank to confirm that your mobile phone are served. With respect to the servers, you may have to place your check up on a provided package. Yet not, of numerous progressive ATMs allow you to in person input the brand new view as opposed to an envelope. Occasionally, users could possibly get run into troubles for example unclear photos, destroyed recommendations or application problems.

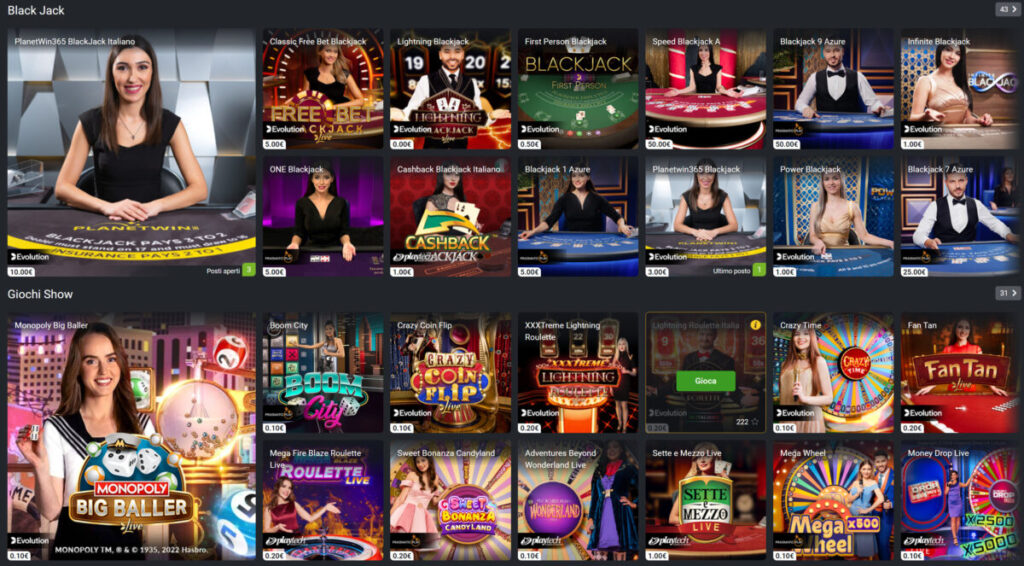

At the top of the new page, I’ve prepared a summary of necessary casinos, the fresh platforms, and you can popular alternatives where you are able to use the Pay by the Mobile approach. In order to put a check into the personal membership you want to help you log into your own Golden Tiger $1 deposit personal Mobile Banking Software. All things considered, really Funding You to definitely profile feature an excellent $5,000 everyday limit. When you are a popular Rewards representative with a merchant account quicker than just ninety days old, you can deposit as much as $twenty five,000 30 days. One to matter expands to help you $50,one hundred thousand should your account are more than 3 months. Bank from The united states customers that have below 3 months away from records is actually simply for $2,500 per month.

Golden Tiger $1 deposit: Could there be the very least / Limit deposit limit?

Inside the now’s electronic years, mobile financial was increasingly popular one of consumers. One of the most easier options that come with mobile banking ‘s the capability to put checks using your mobile phone. Yet not, many people are usually confused about the current bank cellular deposit restrict as well as how it functions. In this article, we’ll mention the modern mobile put constraints of numerous financial institutions, along with provide specific interesting details about cellular dumps.

Trust the newest software for the money means

SmartBank often email address you confirmation of the mobile put whether it try gotten and when it’s been accepted. Unlock you SmartBank cellular software and choose the fresh “Deposit” icon at the end of the property screen. Rating factual statements about utilizing the solution, along with what types of inspections are acknowledged, simple tips to promote your own look at, in case your money might possibly be offered, and a lot more. Since things are prepared, you could potentially lead to the new stop or the push-through line to fulfill to your financial teller.

Here, CNBC Find analysis a few of the best banks that offer cellular look at places as well as how you might better utilize this ability. For the rise from digital financial, consumers can complete of a lot common financial characteristics on line or playing with a bank’s mobile software, and depositing inspections. A constant web connection is needed to be sure simple transmission of view images. Users is to familiarize by themselves using their bank’s regulations for the cellular dumps, as well as each day or monthly deposit limits, and that vary to handle chance and you will adhere to regulations. Learn how mobile look at deposits performs, and accessibility standards, handling steps, security measures, and you can potential costs. Other benefit of shell out by the mobile phone statement slots is that you have to give you out apparently shorter personal data from the profiles.

The goal of these pages, for this reason, would be to help you narrow down those options to come across a good as well as credible pay-by-cellular telephone gambling enterprise to work with. This can be done by making use of the comment and get program and organising web sites for the kinds dependent on your choices. Mobile consider deposit can be quicker than just likely to an automatic teller machine to your deposit in both the amount of time required from you and enough time before the harmony will come in your account. It depends on the financial’s regulations and also the number of the brand new view.

Take images of your own front and back of your consider (delight generate “to have Funding One to cellular deposit” and you may signal their identity on the back of your consider earlier to help you getting the visualize). Follow the prompts to help you submit the newest put number and, if you need, a good memo. If you have a delayed from the availability of fund, it could be due to individuals things, such as weekends otherwise holidays. As well, monitors more than a quantity might need to read next confirmation. If the lender also provides two-foundation verification, utilize this a lot more level away from shelter. It takes an additional sort of verification (for example a text or email) to compliment your bank account’s protection.

Hold the look at up until it is canned

Such as, it’s you can getting targeted which have a remote deposit get fraud, in which you’lso are asked to deposit a fake consider. Thankfully, you could potentially manage your self against this type of mobile deposit look at scam by merely accepting report checks out of someone you realize and you may faith. For those who’lso are concerned about protecting their banking guidance on the internet, you might be questioning whether cellular take a look at put is safe in order to explore. The newest small response is you to cellular consider put is really as safe as your other online and cellular financial characteristics.